Days after Apple launched its new streaming service Apple TV+, The Walt Disney Company followed with its own, Disney+. But while the naming structure appears similar, and both are virtually ad-free, the two services are vastly different. Apple TV+ launched with eight original television series and one movie but no back catalog, while Disney+’s new series were dwarfed by its vast offerings of content from Disney’s own decades-old vaults as well as popular productions from Pixar, Star Wars, Marvel, and National Geographic.

IMA Research surveyed 1,097 people between November 14th and 17th, within days of Disney+’s November 12th launch, and discovered:

- Awareness of Disney+ is extremely strong with 63 percent of respondents knowing about the new streaming service, much higher than Apple TV+ (34 percent)

- Of those aware, 28 percent reported subscribing already or intending to do so

- 40 percent of those who intend to or already subscribed will utilize a free promotion

- Nearly half (47 percent) believe the price of $6.99/month is fair; only 25 percent of respondents find the price to be too expensive

- The Disney/Pixar catalog is its most attractive feature

- 24 percent of respondents who intend to or have already subscribed would cancel an existing streaming or pay service in favor of Disney+

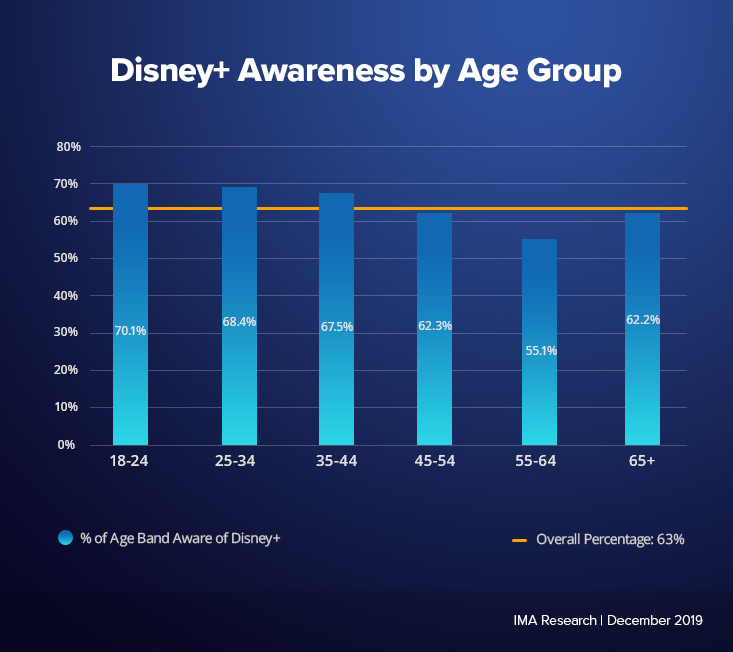

We first asked if Americans knew about the then-days-old service, and 63 percent of the respondents were aware of Disney+. Women (68%) were more aware than men (61%), while age played a role as well. Awareness tended to move inversely to age, with 70 percent of the youngest band comprised of 18- to 24-year-olds aware, dropping to 55 percent of those 55-64. For every age band but the oldest, the percentage aware was lower than that of the next-younger band. Awareness among the oldest age band, 65+, did rebound to 62 percent, but that figure was still below the 63 percent average. In comparison, Apple only achieved 34 percent awareness overall.

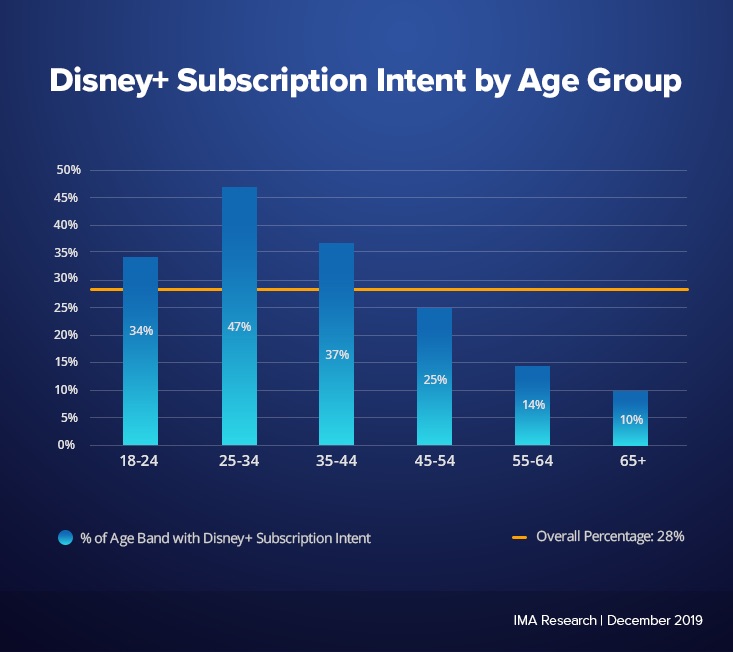

The rest of our questions were confined to those who were aware of Disney+. Among them, 28 percent planned on subscribing or had already subscribed, indicating subscription intent. 49 percent were not planning to subscribe while the remaining 23 percent were not sure. Apple TV+ only achieved 10 percent subscription intent.

As we saw regarding awareness, we also observed an inverse correlation between age and subscription intent. A whopping 47 percent of the 25-34 age band had subscription intent, which dropped with age to only 10 percent of those 65+. For every age band but the youngest, the percentage with subscription intent was higher than that of the next-older band. Intent among the youngest age band, 18-24, came in above average at 34 percent.

Coupled with the 63 percent awareness figure, the 28 percent with subscription intent extrapolates to 18 percent of the U.S. Assuming 128 million households yields a potential penetration of about 23 million households. Among those with intent, 69 percent said they had already subscribed, making the early adopters total over 15 million households. Our estimate is in line with the 15.5 million sign-ups through the first 13 days of launch reported by Apptopia1, which included some foreign subscribers as well. (Disney reported over 10 million sign-ups by the day after launch2.) In comparison, we estimated only 1.1 million households early on for Apple TV+.

But how many of those sign-ups were actually paying customers? Disney offers a number of promotions that lower or eliminate the $6.99 per month subscription fee, including a universal seven-day free trial and a free year for certain Verizon customers. When we inquired as to how those with subscription intent would pay, we learned:

- a large 40 percent (are watching or) will watch through a free promotion;

- 35 percent will pay $6.99 monthly;

- 13 percent will pay $12.99 for a monthly bundle of Disney+, Hulu, and ESPN+; and

- 12 percent will pay a reduced annual fee of $69.99 (which was reduced even further as a Cyber Monday promotion).

If the current and future subscribers break down in this fashion, and we apply it to the 23 million households with intent, they would generate $1.3 billion annually. If the breakdown applies to the 15+ million households who have already subscribed, they would generate $900 million annually. For Apple TV+, even if all the early adopters of 1.1 million households were paying the full fare of $4.99 per month, they would only generate $66 million annually.

We gave suggestions and allowed multiple answers to our question, “What features of Disney+ are most attractive?” Among those who named at least one feature:

- 46 percent selected The Disney/Pixar Catalog;

- 38 percent selected The Marvel/Star Wars/National Geographic Catalog;

- 26 percent selected New original content;

- 25 percent selected $6.99/month pricing; and

- 21 percent selected Promotions to try the service free.

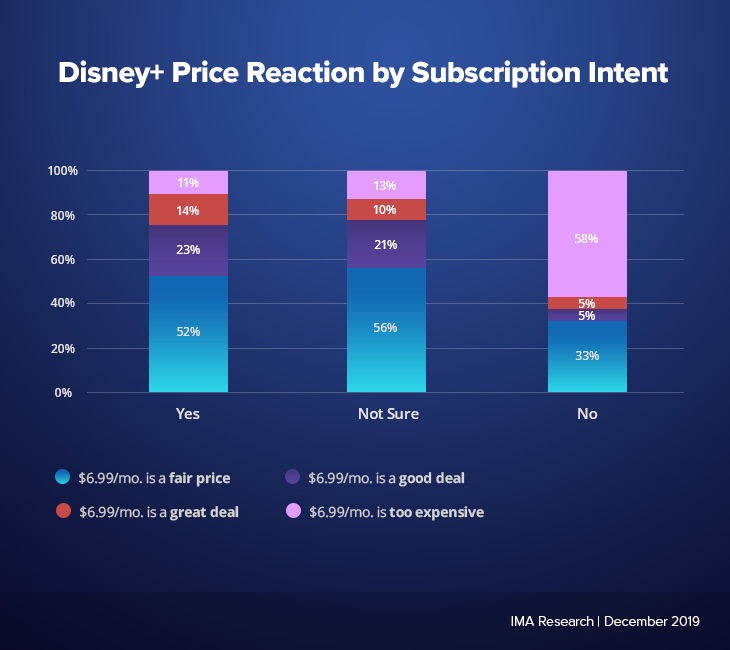

IMA Research dug deeper on the $6.99/month price point. Among those with an opinion on it, 47 percent think the price is fair, with 17 percent finding it a “good” and 11 percent as a “great” deal. 25 percent of those with an opinion on the price feel it is too expensive. When we break it down by subscription intent, we could see the importance of the price tag:

Most of those with subscription intent (52 percent) or unsure (56 percent) feel $6.99/month is a fair price. But a majority of those with no intent (58 percent) feel $6.99/month is too expensive, compared to just 13 percent of the Not Sure and 11 percent of those with intent. Despite many being able to get the service free, price still seems to be a factor against adoption.

Just as IMA Research previously studied the impact the end of Game of Thrones had on HBO and whether Apple TV+ would affect other popular streaming platforms, we wanted to determine how Disney+ would affect Netflix, Amazon Prime and the like. It is too early to predict whether Disney+ will steal significant market share from existing competitors, but 24 percent of those subscribing or intending to subscribe indicated they would cancel an existing streaming/pay service in exchange for Disney+. Interestingly, among the competition, the best predictor of subscriber intent is a subscription to Hulu, which is also owned by Disney and offered in a money-savings bundle with Disney+ and ESPN+. According to Apptopia1, both Hulu and ESPN have seen downloads increase since the launch of Disney+, with Hulu seeing the biggest boost. So even if Disney does steal market share away from its competition, Disney+ appears to be doing a good job so far of not cannibalizing itself.