November of 2019 is a watershed month for streaming television as two important and popular companies, Apple and The Walt Disney Company, launch their own streaming services to consumers. This analysis by InMyArea Research dives into the American public’s awareness and appetite for Apple’s service, named Apple TV+ (or Apple TV Plus), as well as its effects on its competitors.

The service launched on November 1, 2019, with a catalog of eight original television series and one movie. (Contrast that with Disney’s streaming service Disney+, that launched with new series as well as a huge catalog of Disney shows and films, plus selections from Marvel, Star Wars, and other popular offerings.) We surveyed 1,877 American adults during the first week of November and learned:

- 34% of Adults are already aware of Apple TV+

- 10% of those aware, or about 3% of adults, reported subscribing to the new service or intending to subscribe, which would cover about 2.7 million households1

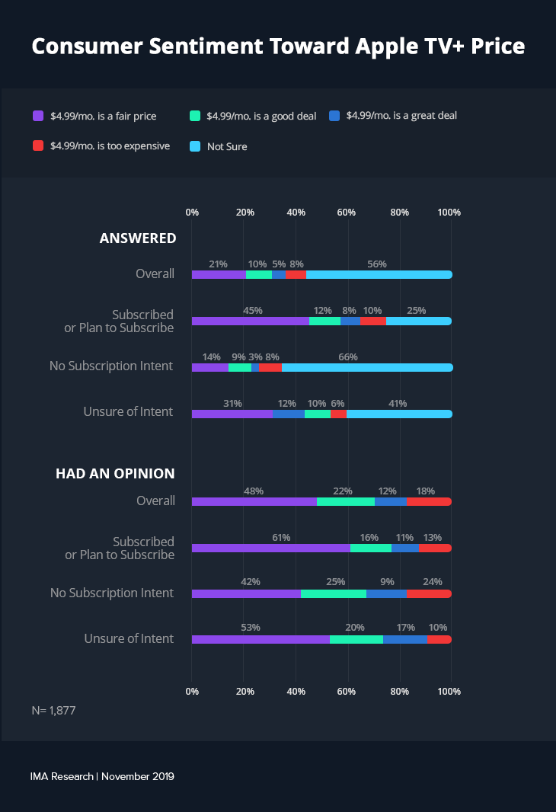

- With an initial price of $4.99 per month, 48% of those with an opinion believe Apple TV+ is at a fair price, 22% feel it is a good deal, 12% feel it is a great deal, while 18% find it too expensive

- It is too early to predict whether Apple TV+ will steal significant market share from existing competitors, but 34% of those subscribing or intending to subscribe indicated they would cancel an existing streaming/pay service in exchange for Apple TV+.

IMA Research first asked about awareness of the service, and 34% of the 1,877 respondents were aware of Apple TV+. Surprisingly, the most aware age group were those aged 45-54 at 45%. The rest of our questions were confined to those who were aware. Among them, 10% planned on subscribing or had already subscribed, 67% were not subscribing, and the remaining 23% were not sure. Assuming 128 million households and 64% of them capable of watching (as few devices other than Apple products can stream the service) yields a penetration of about 2.7 million households. Among those with intent, 42% said they had already subscribed, making the early adopters total 1.1 million households.

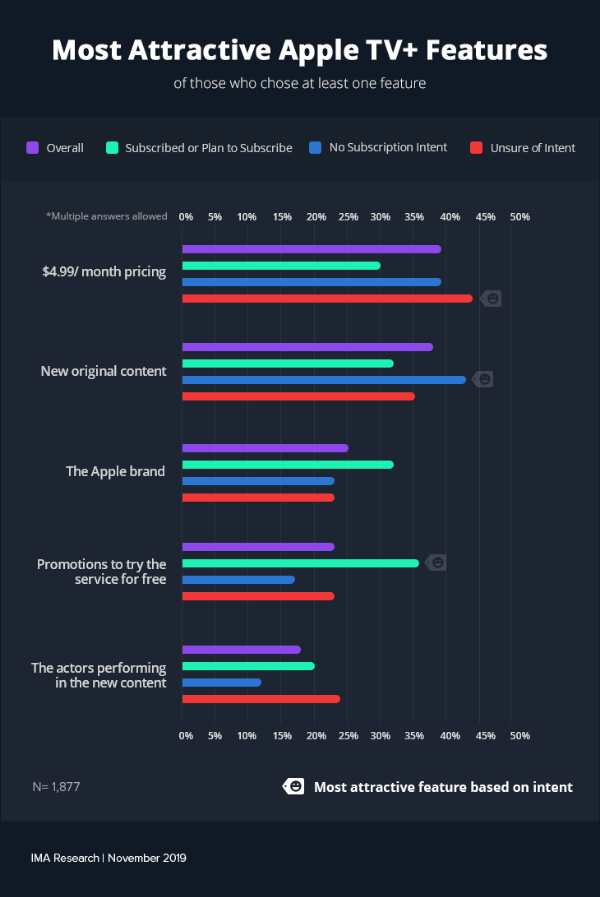

We then attempted to ascertain which features of Apple TV+ people found most attractive and presented them with a list of options. The most attractive feature selected was the $4.99/month pricing, but that Apple TV+ price point was only selected by 15% of the group. As expected, a majority (61%), selected NONE, as only 10% of this group had any intent to subscribe. But when we broke the data down by subscription intent, we discerned distinct differences.

- For those who already subscribed or intend to, the feature named that most respondents found attractive (36%) was the existence of promotions to try the service for free.

- For those with no subscription intent, the feature named that most respondents found attractive (43%) was the new original content.

- For those unsure of subscription intent, the feature named that most respondents found attractive (44%) was the $4.99/month pricing.

This may indicate that many people who subscribed are not paying for the service but are getting it for free. Apple has been offering a year’s access to consumers who buy a new iPhone, iPad, iPod Touch, Apple TV, or Mac, since September 10. In addition, the Apple Student Music Plan also allows free access, and everyone is eligible for a 7-day free trial.2

Speaking of pricing, we wanted to gauge consumer sentiment towards the $4.99 monthly price point. We discovered that 48% feel Apple TV+ is at a fair price, 22% feel it is a good deal, 12% feel it is a great deal, while 18% find it too expensive. But once again, breaking down the data by subscription intent revealed stark differences.

One would assume that a greater percentage of those without or uncertain of subscription intent would find the price too high when compared to subscribers or those who planned to subscribe. But we learned that 10% of people subscribing or planning to subscribe feel $4.99/month is too expensive for the service, greater than the 6% of the people not sure and 8% of those not planning to subscribe. Similarly, among those with an opinion, a smaller percentage of people with subscription intent (16%) found the service to be a good deal than those without (25%) or unsure (20%), while 27% of the people subscribing or planning to who had an opinion thought Apple TV+ is a good or great deal, compared to 37% of the people not sure and 34% of those not planning to subscribe. Once again, this indicates that many early adopters may not be paying for the service.

If we take the 27% of those with subscriber intent who think Apple TV+ is a good or great deal and assume those are paying customers, that leaves us with 300,000 current subscribers being billed $18 million annually. Even if all of our estimated 1.1 million households are paying, that would only generate $66 million in a year. If Apple did spend $6 billion on its initial programming slate as reported3, then Apple TV+ certainly appears to be a loss-leader designed to get people into the Apple ecosystem.

Just as IMA Research previously studied the impact the end of Game of Thrones had on HBO and losing The Office will have on Netflix, we wanted to determine how Apple TV+ would affect other popular streaming platforms. It is too early to predict whether Apple TV+ will steal significant market share from existing competitors, but 34% of those subscribing or intending to subscribe indicated they would cancel an existing streaming/pay service in exchange for Apple TV+. While that number appears high, with the initial subscriber intent so low, and the universe of paying households even lower, other streaming companies such as Netflix don’t appear to have much to worry about in the near-term from their Cupertino competition.