Homeownership is a traditional cornerstone of the American Dream, but current economic conditions make that dream an unattainable fantasy for many young adults.

Even as inflation subsides and interest rates drop, nationwide housing shortages keep markets tight and prices historically high. Some adult Generation Zers (aged 18-27) and Millennials (aged 28-43) can rely on family generosity as others hustle to accrue savings, uncover bargains, or invest in improvable assets. Alternately, many young adults now reject mortgages as adulthood’s Holy Grail, choosing to embrace alternate priorities.

InMyArea.com surveyed 2,500 Americans of all ages to assess how home ownership attitudes and logistics are shifting across generations. We focused specifically on Gen Z and Millennials to determine whether owning a home is important to young adults, how they are achieving it, and whether they have any regrets after purchase.

Key Findings:

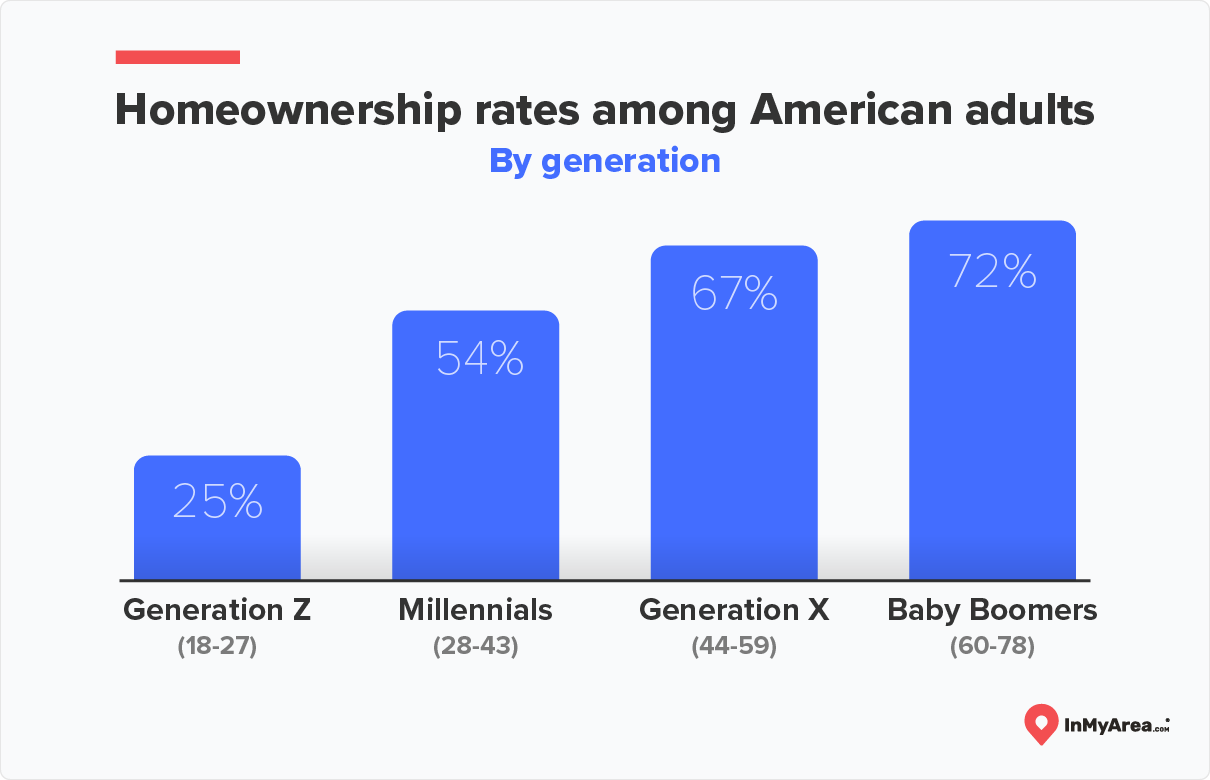

- About a quarter of Generation Z adults (ages 18-27) own their own homes, and approximately the same number live with their parents.

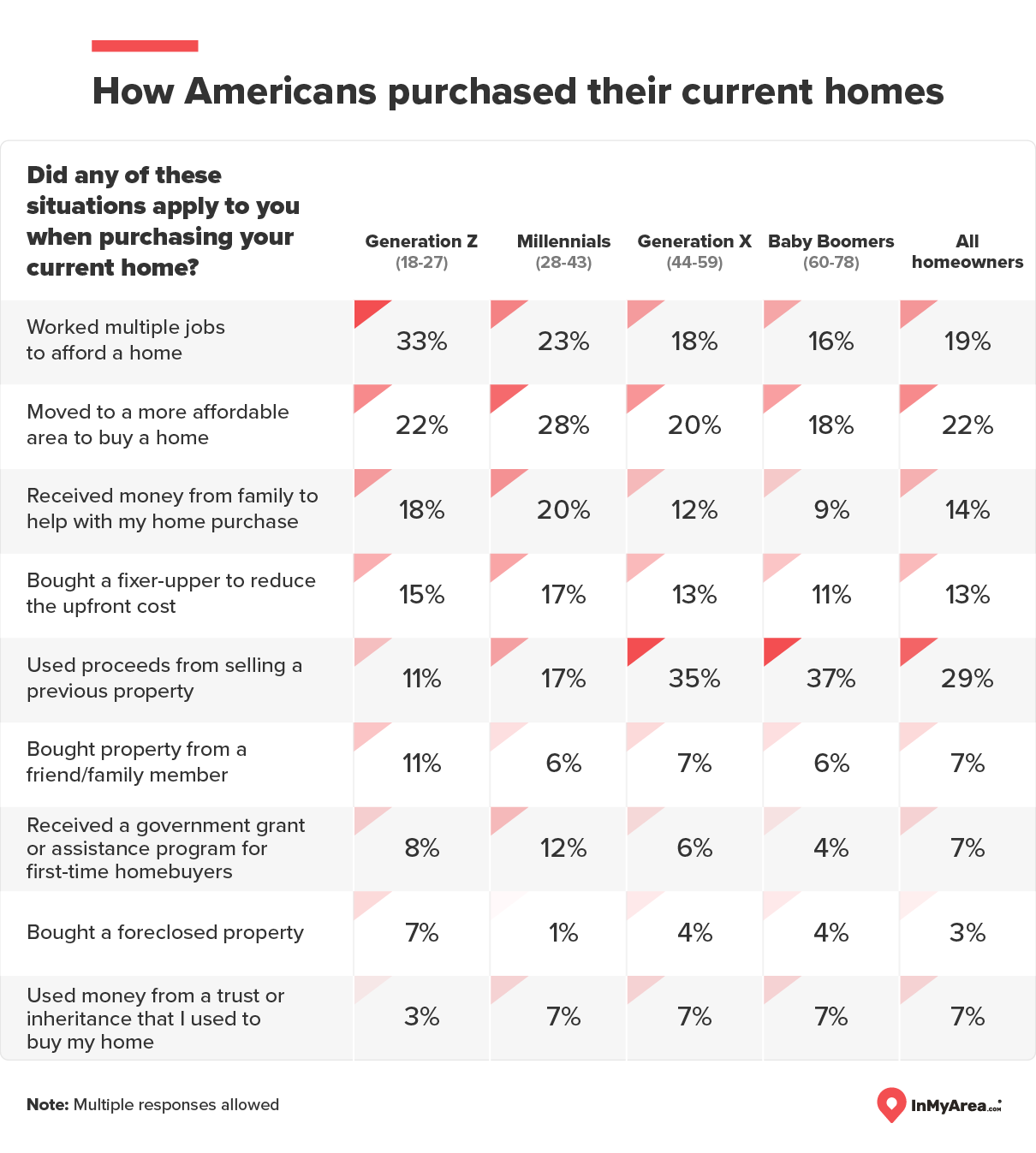

- One in three Generation Z homeowners worked multiple jobs to afford their current home and one in five relocated to a more affordable area to purchase a home. They were also the generation most likely to purchase a foreclosed property.

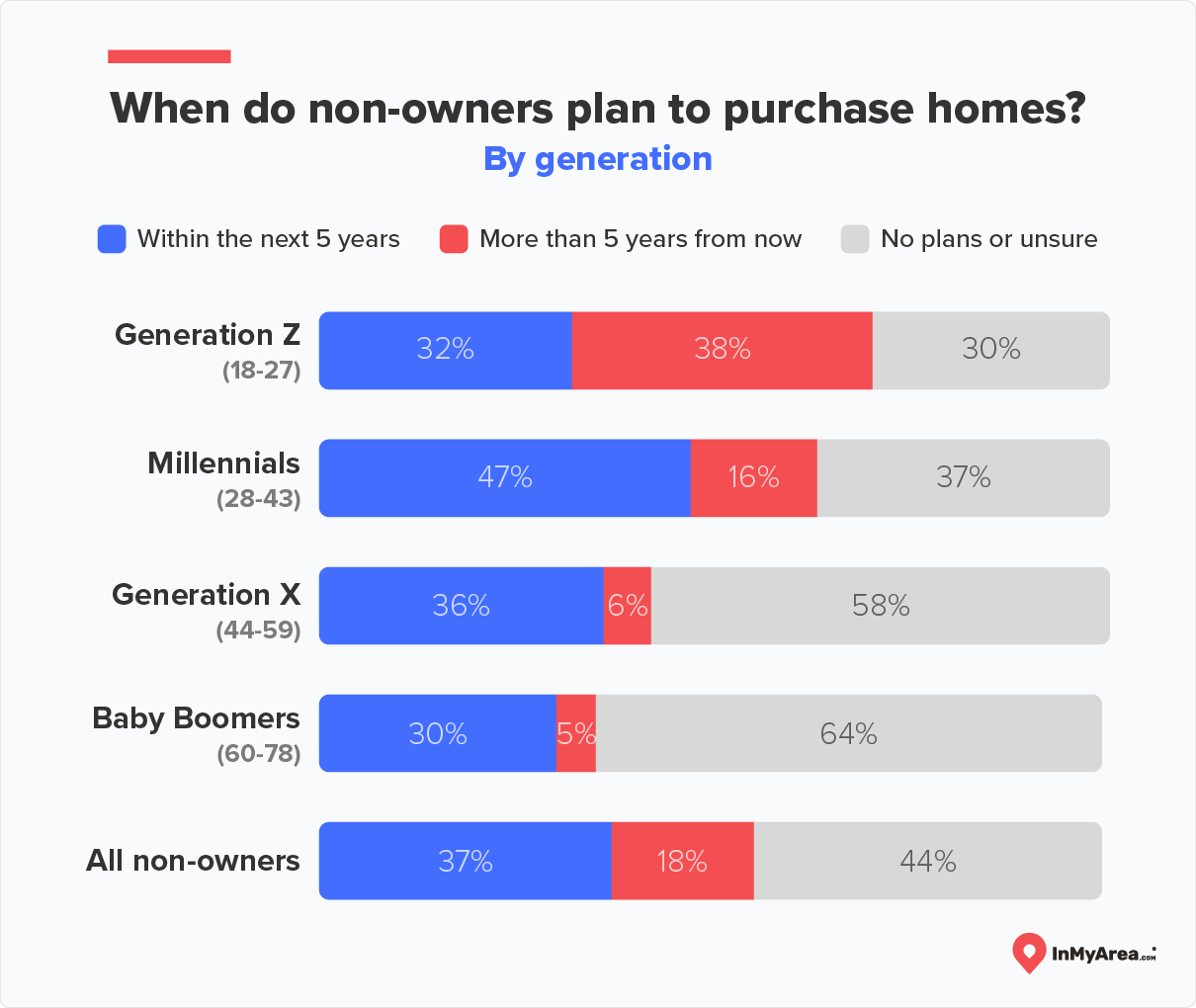

- Nearly a third of Generation Zers without homes plan to buy within the next five years, and 60 percent say they would buy soon if interest rates continue to drop.

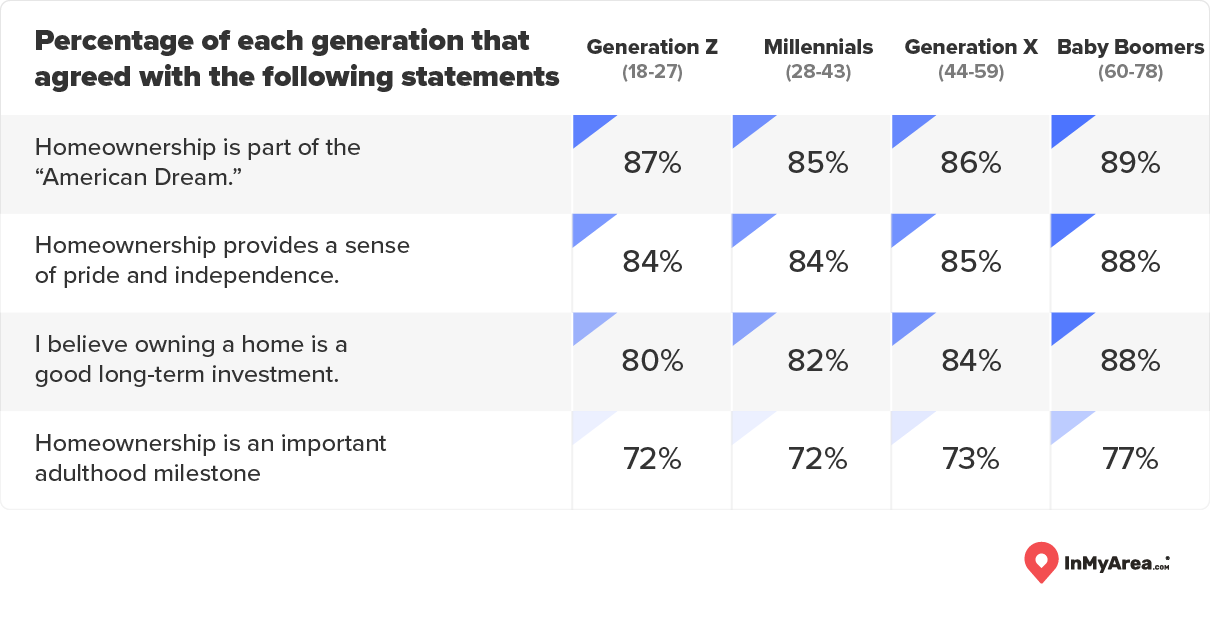

- 87 percent of Generation Zers still believe homeownership is part of the American Dream, but more than a third of them say they’d rather invest in experiences than own property.

- 8 in 10 Gen Z homeowners said they have some regrets about their purchases, most often related to the financial burden of owning a home.

The State of Home Ownership Among Young Americans

American home prices have soared beyond wage growth for several decades. Up 54 percent in the last five years alone, the median sales price has skyrocketed almost 350% since 1990. Unsurprisingly, the average age of a first-time home buyer has similarly escalated – jumping from 29 to 35 over that sameperiod.

Housing costs are currently at all-time highs—almost $420,000 for a previously built home and nearly $500,000 for new construction. High mortgage rates and lagging incomes mean that home affordability recently hit its lowest level in 40 years, beyond the reach of most Americans.

Despite these obstacles, we found that one-quarter of adult Generation Zers (ages 18-27) and most Millennials (28-43) already own their current residences. Seven in ten Gen Z adults who don't yet own homes plan to buy a house, and one-third hope to close a deal in the next five years.

Even more young adults may join the homeowning ranks if economic conditions cooperate. Six out of ten Generation Zers and Millennials told us they’d consider buying a house when interest rates drop, which appears on the horizon after recent moves by the Federal Reserve.

Some Gen Zers Have Resources, Others Are Resourceful

High inflation, sluggish wages, and employment disruption caused by the pandemic, globalization, and AI’s emergence have forced young adults to be professionally adaptable. Generation Zers and Millennials have mastered the art of the side hustle, tailoring careers to fit the new gig economy.

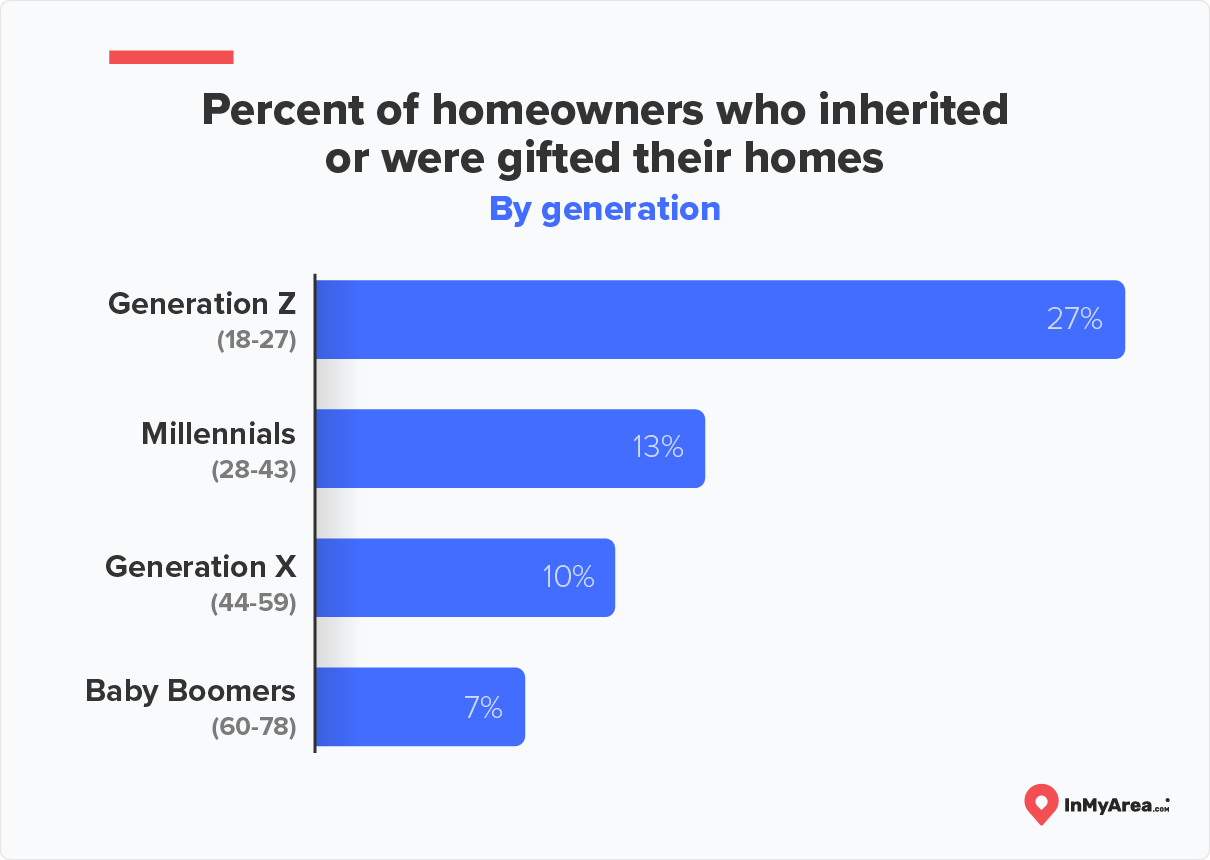

Some harness this same creativity and motivation when saving for a home, while others have a head start. More than one-quarter of Gen Z homeowners inherited or were gifted their current abodes—a ratio twice as high as that of any other generation.

Many other so-called "nepo-homebuyers" received some form of family assistance. Nearly one-third (31 percent) of Generation Zers and Millennials used inheritances, family funds, or bought houses from family/friends (presumably under favorable conditions).

With a widening generational wealth gap, it’s natural for able families to help younger members get on their feet. Today’s average Millennial possesses 30 percent less wealth and has a 20 percent less chance of owning a home than Baby Boomers did at that same age. Some of those without affluent grandparents turn to their Uncle Sam: around one in ten Generation Zers and Millennials used government grants to help finance their first home.

Even with assistance from family or the state, hard work is often required. One-third of Generation Zers who bought their homes juggled multiple jobs to make ends meet. These efforts are no surprise. Financial anxiety has driven many young Americans to take second jobs, perform freelance work, or run part-time hustles to gain an advantage.

Some young buyers further upended their lives in the search for a first home. One in five Generation Zers relocated to find more affordable housing, a tactic employed by more than one-quarter of Millennials. The rise of remote working has liberated young professionals from the confinement of commuter zones, allowing Generation Zers to move to the South or undervalued metro areas where they can stretch their housing dollars.

Beyond seeking lower-priced markets, many young Americans scour the country for distressed properties available at rock-bottom prices. Perhaps influenced by reality house-flippers or house renovating TikToks, more than 20 percent of Gen Z home buyers invested in foreclosed or fixer-upper places. Purchasing damaged goods or properties in distressed areas lowers upfront costs, but buyers should be aware of the risks. Ballooning renovation bills, zoning nightmares, and unforeseen market fluctuations can quickly depreciate investments.

Some industrious young homeowners stay resourceful even after the closing: 11 percent of Gen Zers rent part of their new homes to family, friends, or tenants. This approach helps share the costs and could help battle Gen Z’s loneliness epidemic.

Young Americans’ Attitudes on Homeownership

Much has been made about the erosion of the time-honored American Dream among younger generations. Beset by debt, put off by politics, and disillusioned with conventional educational or professional tracks, some Generation Zers and Millennials envision different paths. For them, happiness centers more around personal fulfillment than material wealth or nuclear families.

Yet home ownership still holds strong appeal among those generations. Like their elders, a large majority of younger adults believe that home ownership is a milestone of adulthood, provides a sense of pride, and remains part of the American Dream.

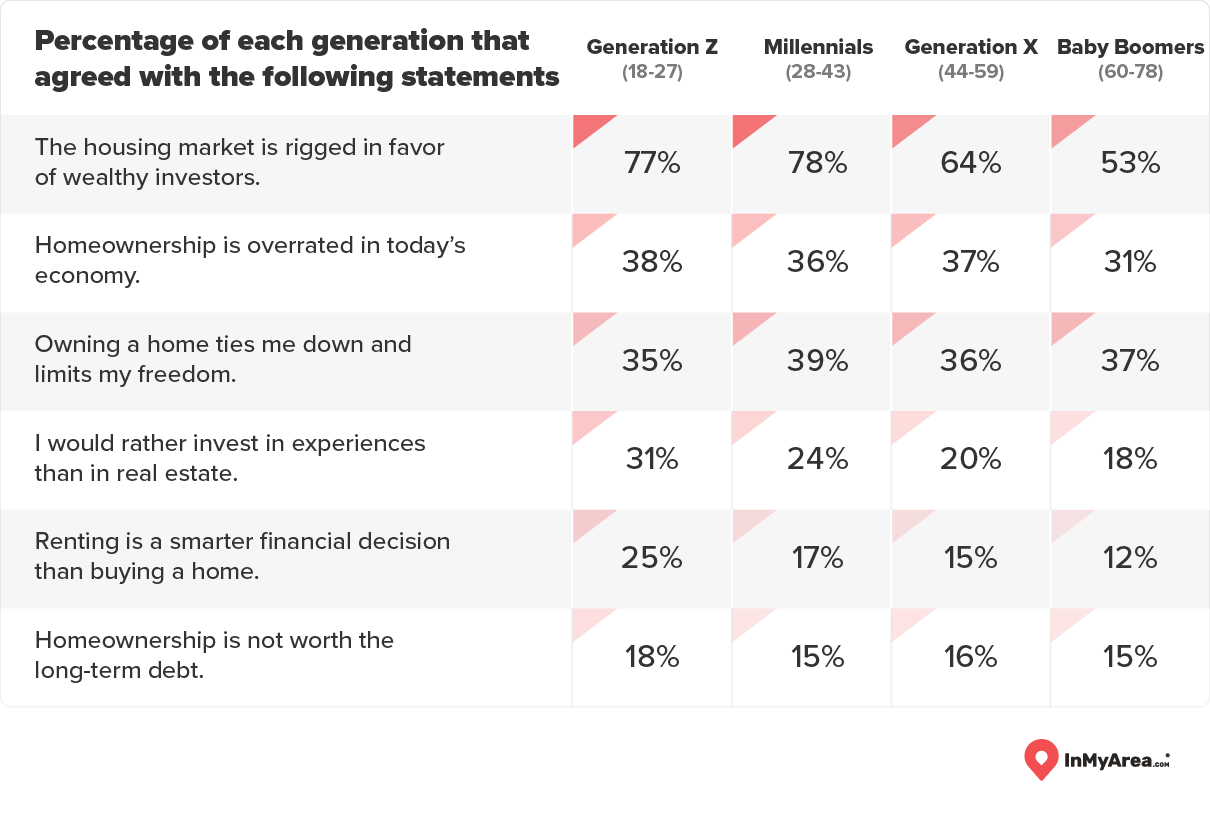

Similarly, 80 percent of Generation Zers and 82 percent of Millennials agreed that owning a home is a good long-term investment and worth incurring debt. Yet Generation Zers are also far more likely than others to see renting as a wiser financial choice than buying a home.

This perspective may be rooted in sound financial acumen, as many experts advise renting in today’s market – especially those living in cities.

That opinion may also derive from more cynical views of home ownership. More than one-third of Generation Zers and Millennials believe that owning a house is overrated. Those generations are also much more likely to view the housing market as a racket rigged in favor of wealthier investors.

Over one-third of younger adults also believe owning a home ties them down and limits their freedom. Generation Zers, in particular, would rather invest their hard-earned funds in experiences than pieces of real estate.

Before investing in real estate over life experiences, prospective young home buyers can learn from the experiences of those who’ve already invested in real estate.

Homeowner Challenges and Regrets

Homeownership remains an essential element of the American Dream, and many young adults expect it. Forty percent of Generation Zers who don’t yet own a house feel pressured to join the home-owning ranks.

With home ownership considered a status symbol, an indicator of financial security, or a sign of maturation on the road to establishing a family, some young adults take the plunge out of obligation. Many regret that decision or wish they’d approached it differently.

Three out of four homeowners had some regrets about purchasing a house, and that number rose to 80 percent among Generation Z and Millennial homeowners.

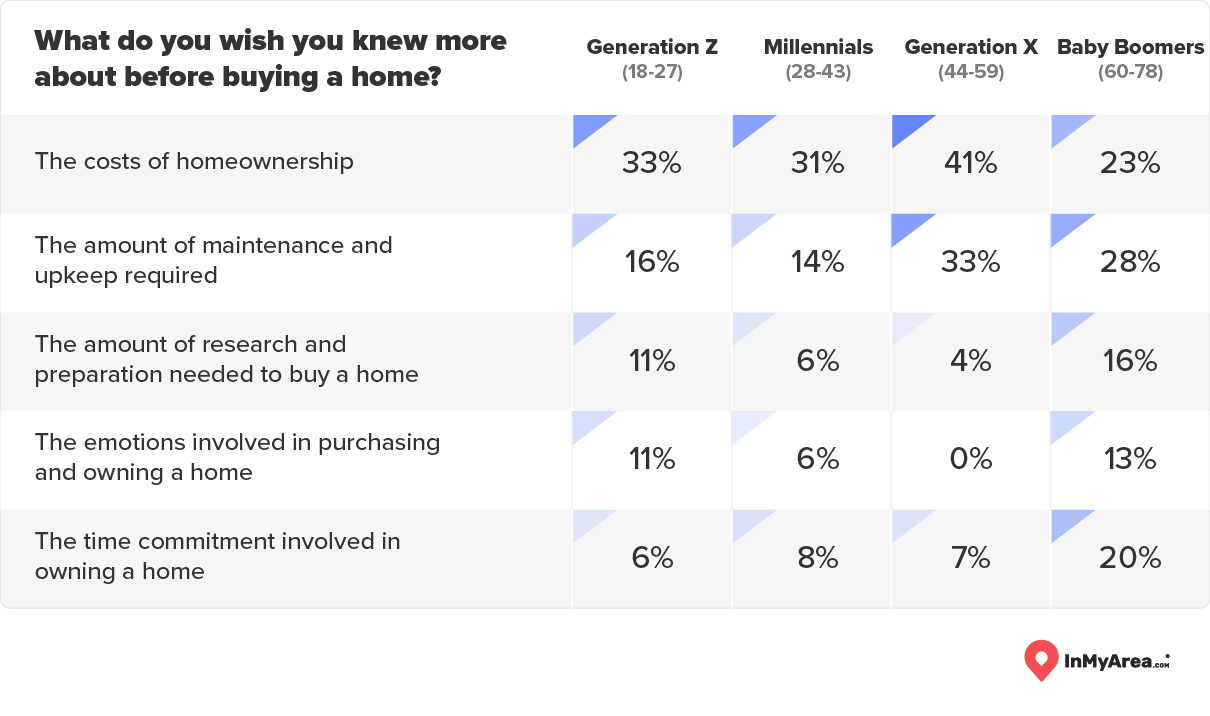

Before succumbing to societal pressures, young adults should heed the advice of those who’ve purchased homes before them. Eighty-five percent of homeowners – and 89 percent of Generation Zers and Millennials – wish they’d known more before buying a house. The unexpected obstacles cited by homeowners fell into several categories:

Here are the main things homeowners wish they’d known more about before purchasing their homes:

Hidden costs: About one-third of homeowners said they wished they had been more aware of the hidden costs of owning a home. For some, the surprise came right away with high closing costs and unfavorable interest rate calculations. Others were hit with unexpected repairs. Many mentioned ongoing expenses like property taxes, insurance premiums, utility bills, and HOA fees, which were often higher than expected and increased over time. Several suggested setting up an emergency fund to cover these unforeseen costs.

Maintenance costs: A big shift from renting to owning is being responsible for the property’s upkeep. Homeowners were surprised by the amount of time, effort, and money needed for maintenance. Many wished they had been handier or found reliable help earlier. They recommended budgeting for regular upkeep, investing in preventive maintenance, learning DIY skills, and being aware that older homes or larger properties require much more work.

Commitment and stress: Homeownership isn’t just a financial and time commitment – it can also take an emotional toll. Some homeowners felt overwhelmed by the responsibilities or stressed by the permanence of owning a home. To manage the stress, they advised patience, staying organized with paperwork, and being mentally prepared for the commitment. A few admitted that homeownership might not be the best choice for everyone and that some may be better off renting.

Many homeowners regretted not doing enough research before buying. Some missed out on better financing options, while others weren't as thorough with inspections or negotiations. They were also caught off guard by undisclosed fees, neighborhood characteristics, or strict HOAs. Many also realized too late that their homes didn’t fully suit their needs or future plans. The key advice? Take your time, work with trusted professionals (inspectors, bankers, realtors), get second opinions, research costs thoroughly, save for a large down payment, and consider how your home will fit your family’s or career’s future needs.

Overall, Gen Z homeowners were twice as likely as Millennials to express regret about being unprepared and the emotional strain of homeownership. This suggests that younger buyers should be particularly careful about doing thorough research and preparing for the stress that comes with owning a home.

To balance the feedback, many homeowners shared positive experiences as well. Some had no regrets, others wished they had bought their homes even earlier, and many felt that the benefits far outweighed the challenges. As one respondent from our study said, "There will be bumps in the road, just relax.”

Conclusion

Buying a home is part of the American Dream and is considered a rite of passage into adulthood. However, purchasing a house has also become increasingly expensive. A perfect storm of high interest rates, low inventory, and runaway inflation has made homeownership historically unaffordable, especially for younger adults.

Despite encouraging economic signs and political promises, most agree that the market is likely stuck for the foreseeable future.

Despite these obstacles, home ownership remains a lifestyle and investment goal for many Generation Zers and Millennials. One-quarter of Gen Z already owns a home, and 70 percent of the rest aspire to the same. They're working multiple jobs, seeking good deals, turning to family, renting out space, and even relocating to turn dreams into reality.

Many have rushed into purchasing property, resulting in regret and unforeseen obstacles. This difficult market moment affords young Americans the opportunity to save up their money, do all their homework, make informed decisions, and emerge as happier homeowners.

Our Data

In September of 2024, InMyArea.com conducted an online survey of 2,495 American adults spanning the 50 states and the District of Columbia. 57 percent held an ownership stake in their residence.Their ages ranged from 18 to 86 with a median age of 46; 17 percent were from Generation Z, 30 percent were Millennials, 31 percent from Generation X, and 22 percent were Baby Boomers. 51 percent were women, 49 percent were men. Ethnically, 63 percent identified as White, 12 percent as Black, 6 percent as Asian, and 19 percent as multiracial, another ethnicity, or preferred not to specify.